Startup Due Diligence. What is it and why it is crucial?

The term “due diligence” refers to the investigative process on the claims and potential of a startup with the aim of providing prospective investors with all material information regarding the offered securities, without a material misstatement or omission in the circumstances, prior to making an investment.

When it comes to early stage startup investment the task is event more challenging as there are not existing revenues streams to assess and to further project.

There are two types of due diligence: 1) the fact checking 2) the strategic assessment.

While the first is the basis of any due diligence, the second is not executed by all organizations and its implementation varies significantly across different assessment companies.

Let’s see in detail the two types of assessment:

Fact Checking.

This section is mainly aimed to answer one question: “are the startup owners saying the truth?”

The facts which are screened, analyzed and assessed are mainly related to numbers: web traffic, real users, conversion, adoption, social media engagement, SEO related pages,

The task is not as easy as you might think as the chance is that these numbers are just fake as already covered here.

Other areas of the assessment vary according to the industry and can include customer and partner commitments, budget, regulatory need and approval, IP, organization structure, governance, formal documentation, product specs, market profit pool….

The strategic assessment

Here is where the assessment gets thought-provoking. Here is where a proper due diligence can represent the additional value for making an investment decision.

This is the delicate process of converting unknowns into calculated risks.

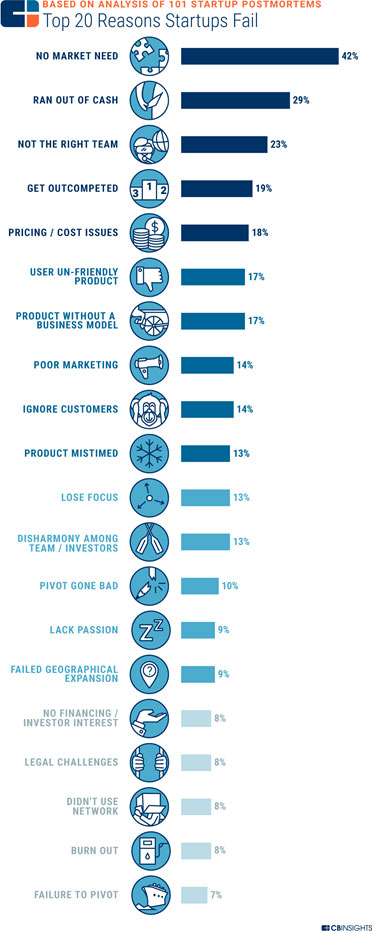

In this phase, the analysts conducting the assessment need to ensure that the company they are reviewing will not fall into the most common reason of failure of most startups as shown in the below CB Insights visualization[1]:

The screaming commences on the team, the market and the product. The first defines if the startup has the potential to deliver on its promises and the other two are crucial to understand the financial appeal of the investment. In case of a positive outcome, the scope spreads to cover legal, financial aspects, timing and exit strategies.

Checking numbers is not anymore enough to properly deliver this task. What is assessed here is the logic of the overall proposition, the business sounding of the idea that the company wants to bring to market and they way it’s thought to be done. Each statement needs to be questioned, each assumption should be challenged, and alternatives scenarios have to be considered.

Who should execute the due diligence?

You will receive different answers to these questions.

Our belief is that to produce a valuable assessment, the analyst needs to have experience in the industry of the analyzed startup as well as multiyear experience in startup assessment and investment.

And this is just the start. The right person to conduct due diligence is somebody who is not satisfied to simply read a pitch but he’s someone who logs in as a customer in the portal of the startups, speaks to their customers (if any), leverage on its network to grasp buzz about the company and its founders, asks additional questions, requires further data and signs off only when he has a certainty that his assessment has all the needed information.

This is the type of analyst you should rely on when considering a startup investment.

It’s important to note that in any strategic due diligence there is endogenous subjective factor of the person conducting the assessment. The analyst could be influenced by the way the CEO speaks or his reputation, by the technology used, by the feedbacks heard about the company…the influencing catch are unlimited. And subjective factors cannot be removed; however, they can be mitigated. Due diligence conducted, independently, by more than one expert are the best way to ease any subjective influence as it harder that multiple experts will be affected by the same catch.

For more information about Bloomio’s Due

Diligence see here,

while the full list of Bloomio’s expert is available here.

[1] https://www.cbinsights.com/research/startup-failure-reasons-top/